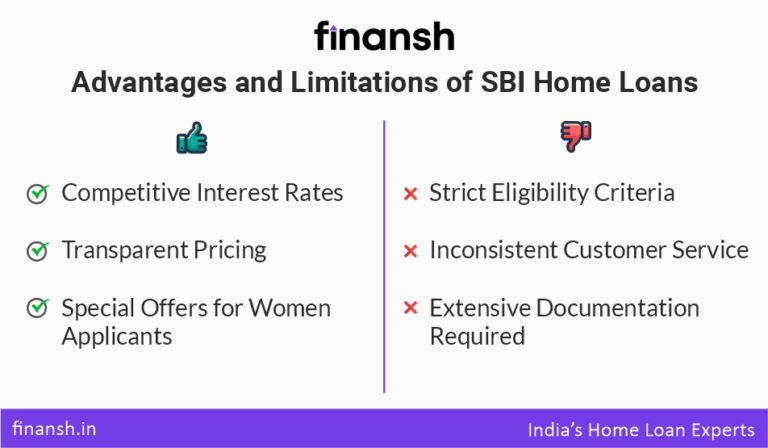

SBI Basic Home Loan

State Bank of India Basic Home Loan is the most popular choice among SBI’s home loan products. It is designed for both salaried and non-salaried individuals. The individuals must be between 18 and 60 years old. Salaried employees need at least one year of work experience. Self-employed professionals and business owners need at least two years of experience.

SBI Basic Home Loan is offered to borrowers with CIBIL scores starting from 550. The loan tenure extends up to the age of 70 or retirement, whichever comes first. SBI Home Loan Interest rates for basic home loan product vary from 8.40% to 9.65% (After applying the discount valid till 31st March 2024)

SBI Maxgain Home Loan

State Bank of India Maxgain Home Loan is an overdraft facility. It is suitable for those who occasionally have extra funds to park. It allows you to deposit your surplus money in this account. This reduces the principal and thus the interest you pay in the long term. If you need the extra funds later, you can easily withdraw them.

However, you need to pay the regular monthly EMIs as in a normal home loan. The amount for SBI Maxgain Home Loan ranges between Rs. 20 Lacs to Rs. 3 Cr, with an extra interest of 0.40% over SBI basic home loan interest rate. For example, if your SBI Basic Home Loan Interest Rate is 8.40%, you will have to pay 8.80% for switching to SBI Maxgain Home Loan.

SBI Flexipay Home Loan

SBI Flexipay Home Loan is specially designed for young salaried professionals. It allows them to borrow 20% more than they normally could. This scheme is for salaried people, aged 21-45, with at least 2 years of work experience. The minimum loan amount is Rs. 20 lacs. It offers the same interest rates as the SBI Basic Home Loan.

SBI NRI Home Loans

SBI NRI Home Loans cater to Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) who hold a foreign visa or passport. It is largely similar to the SBI Basic Home Loan. However, it is tailored for NRIs, requiring a minimum of two years of work experience in India or abroad.

The minimum loan amount is set at Rs. 3 lacs. The main difference lies in extra documentation like visas and work permits. This reflects the unique circumstances of NRIs.

At Finansh, we have a dedicated team to assist NRIs in applying for SBI NRI Home Loans in Pune, Mumbai, and Bangalore. Book a free call with us or drop us an email at [email protected] to connect with our NRI Home Loan Expert.

SBI Realty

SBI Realty provides home loans for purchasing land to construct your home. This scheme is only for salaried customers. SBI Realty offers loan amounts ranging from a minimum of Rs. 5 lacs to a maximum of Rs. 15 cr. SBI Realty home loan gives you a maximum construction period of 3 years to construct your home. SBI Realty offers a maximum repayment period of 10 years. This makes it an attractive option for those planning to build their own homes.

Rate of Interest for SBI Realty Loans is 0.30% higher than the basic SBI home loan interest rate you get as per your CIBIL Score

If your SBI Realty home loan exceeds Rs 3.00 Crores, the interest rate for CIBIL scores above 749 will be 10.90%, and for scores between 700 to 749, it will be 11.10%.

SBI Home Top-Up Loan

SBI Home Top-Up Loan is designed to meet the extra financial needs of existing Home Loan borrowers. You can use the funds for personal purposes. These include education, marriage, healthcare, and home-related expenses such as repair or renovation. No detailed proof is required for the purpose the funds are to be used. To qualify for this top-up, the Home Loan limit should be above Rs. 30 lakhs, and property possession must be complete.