Quick Note: When determining your home loan eligibility, all additional costs, including GST, maintenance charges, and one-time payments (except stamp duty and registration fees), are included in the property’s value. Additionally, you can avail up to 90% bank finance based on the property’s latest evaluated value.

Finansh Alert: Be Careful! Offers promising ‘100% Home Financing’ often come with misleading interest rates, hidden fees and tricky terms.

Understanding Interest Rates

Interest rates are crucial; they are the heartbeat of your home loan. They determine how much you will end up paying back to the bank over time. Home loans in India are primarily of two types: Fixed Rate Home Loan and Floating Rate Home Loan.

Fixed Rates: Your monthly EMI stays the same, offering you some predictability, however at the expense of higher initial interest rates.

Floating Rates: The interest rate can vary based on market conditions. While this may lead to savings, it also introduces an element of uncertainty. For instance, a rate hike by the RBI could increase the interest you pay and vice-versa.

Let’s have a side-by-side comparison of the two:

| Criteria | Fixed Rate | Floating Rate |

|---|---|---|

| Rate Stability | Medium | Low |

| Flexibility | Low | High |

| Initial Interest Rate | Generally 0.5-1% Higher | Lower than Fixed Rates |

| Affected by Market Conditions | Indirectly | Directly and Immediately |

| Prepayment Penalty | Charged by Most Banks | Nil |

Can you predict trends of Interest Rate movements in floating rate loans?

Guessing where interest rates will go is like trying to say if it will definitely rain at 4 PM tomorrow. There are many things to consider, and even then, you can’t be 100% sure. Interest Rate movement is influenced by multiple factors such as global economic conditions, inflation, and government policies. However, being aware of these indicators can offer some foresight.

Contrary to common misconceptions, floating rates have often proved beneficial in the long run, resulting in savings for home buyers.

Also, note that the most suitable interest rate for you may not necessarily be the lowest advertised one.

How do you compare Home Loan Interest Rates?

When you look at home loan interest rates, you’ll see they’re a sum of three main parts. First, there’s a benchmark rate, usually the Repo Rate set by the Reserve Bank of India (RBI). This rate is straightforward, transparent and easy to understand.

Second, there’s the Credit Risk Premium, influenced by your credit score and other factors of your financial profile. Banks only change this rate if your credit score drops.

The third part is where it gets tricky: this is known as Business Strategy Pricing (BSP), which can either be a premium or a discount. Initially, the BSP might make a bank’s home loan offer appear very appealing by allowing for a low initial interest rate.

But here’s the catch: a bank can adjust the BSP at its own discretion, based on its internal policies. This means that a loan that starts off with low interest today could become much more expensive in just a year or two. It’s a crucial detail to keep in mind when comparing home loan options, as it can have a significant impact on the total amount you end up paying.

Pro Tip: Even if you have a home loan with a “fixed” interest rate, the bank can still change it every 2 to 5 years. This is because of something called a ‘reset clause’. So, it’s never fully under your control.

Understanding EMI: The Magic behind Numbers

The EMI, or Equated Monthly Instalment, represents your monthly financial commitment to your lender.

So, what goes into this critical figure?

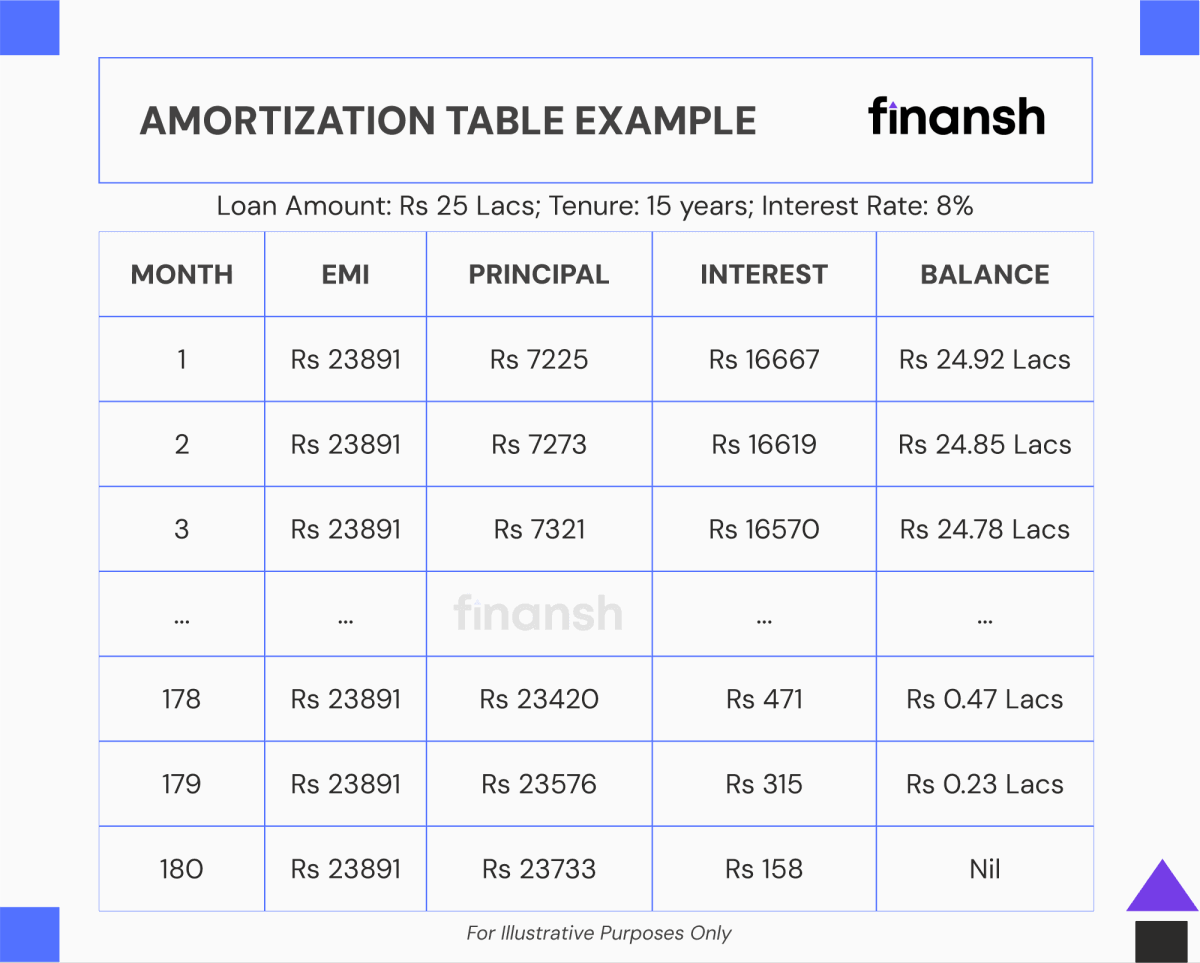

Your EMI consists of two components: the principal and the interest. In the early stages of your loan, most of your EMI covers the interest, but as you make more payments, the principal starts to claim a larger share. This is called amortization. Let’s understand Amortization with an example:

Example: Let’s say you’ve borrowed ₹25 lakhs at an interest rate of 8% for 15 years. Your EMI would be approximately ₹23,891. Initially, a large part of this EMI goes towards paying off the interest, but as time progresses, a larger portion starts reducing the principal amount.

Be aware that when interest rates shift, lenders generally extend the loan duration rather than tweaking your EMI. You do have choices, though: you can opt to alter your EMI, adjust the loan tenure, or simply make up the difference in a lump-sum payment.

Word of the Wise: Small pre-payments to your home loan have a big impact. They directly reduce your principal amount hence saving big on future interest.

The Credit Score: Why It Matters and How to Improve It

Your credit score (CIBIL, CRIF, Experian etc.) is like your financial character certificate. Your Credit Score is the major factor that determines how expensive a loan will be for you. A score above 700 is favourable, but a lower score doesn’t mean the end of the road. You still get a loan but at a higher interest rate.

How to Improve your Credit Score

1. Timely Payments: Don’t miss due dates, be it credit card bills or other loans. If you missed one, make it regular asap.

2. Credit Utilization: Keeping the credit utilization ratio below 60%. If you have a credit card limit of Rs 2 lacs, don’t keep the utilized limit above Rs 1.2 Lac for a long time.

3. Credit Mix: Having a diverse set of credit products like credit cards, car loan, and a home loan helps improve your credit score.

4. Old Accounts: Maintaining old credit cards or loan accounts is important as they add points to your credit history length.

5. New Credit: Don’t take multiple new credit cards or loans in a short period, as it negatively impacts your credit score.

6. Dispute Errors: Check your credit score once a while and raise a dispute for any error you find in your report.

7. Settlements & Write-offs: If you ever opt for loan settlement or have a write-off in your credit card, it damages your credit record permanently.

8. Secured Credit: If you have a negative credit score, try taking a credit card against a FD or a small loan to build one.

Insider’s Tip: Improving your CIBIL score by just 50 points leads to an interest rate reduction of up to 1.0% by big banks.

Choosing the Right Lender: Banks vs Others

The lender you choose will be your partner for years, maybe even decades. Make sure to choose one that meets your needs and trustworthiness. Don’t rush into a decision with the first lender that comes your way.

While banks are generally strict in their eligibility requirements, they offer better interest rates. Housing Finance Companies (HFCs), on the other hand, provide more flexibility in their criteria but usually at the cost of higher interest rates.

It’s worth noting that most banks link their interest rates to external benchmarks, like the RBI Repo Rate, making their pricing more transparent. HFCs, however, often base their interest rates on internal metrics, which can sometimes complicate understanding of the interest rate they offer.

While some suggest taking a loan from an HFC and later transferring it to a bank, be aware that this strategy has its own set of costs and challenges. It’s wise to compare offerings from various banks and HFCs before making a final decision.

Quick Tip: If you’re leaning towards an HFC for your home loan, make sure you fully understand how market fluctuations will impact their interest rates.

Hidden Costs: Fees, Penalties, and the Tricky Parts

The sticker price of a home is not the final cost. Your home loan agreement might include several charges that are not obvious but can add up:

Processing Fees: These one-time fees cover the cost of processing your loan application. Be sure to negotiate this fee and keep an eye out for special offers.

Late Payment Fees: If you miss an EMI, expect a penalty, typically around 2% of the outstanding amount for each month overdue.

Pre-payment Fees: If you want to settle your loan early, you can always prepay your loan. Luckily, most lenders in India have now waived off pre-payment charges, especially for floating-rate loans.

Also, when budgeting for your home, don’t forget to account for additional expenditures such as mortgage charges, stamp duty, property insurance and property registration fees.

Eye Opener: Processing fees can range from 0.25% to 2% of the loan amount depending on the lender.

On a ₹50 lakh loan, that translates to anywhere from ₹12,500 to ₹1,00,000 – quite a range, right?

Essential Documents

Documentation always feels like a headache, but when it comes to home loans, it’s a headache we can’t escape.

What you do need are essential documents like ID and Address Proof, Income Proof, and Property Papers.

Our comprehensive Checklist of Documents for Home Loan ensures you have all the required paperwork in place.

Quick Fact: You don’t need a pre-existing relationship with a bank to secure a home loan.

The Golden Perks: Tax Benefits

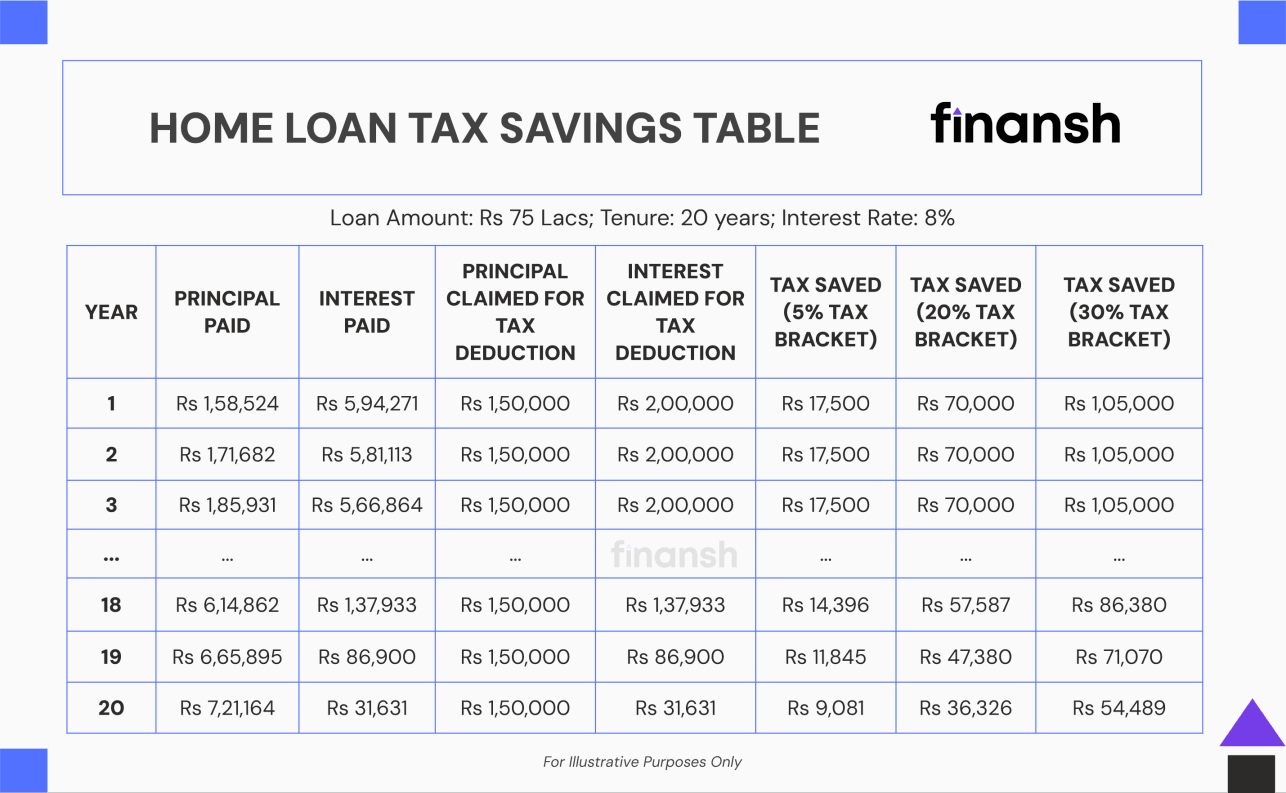

A Home Loan EMI is not just a monthly expense; it is also a special tax-saving tool. Indian Income Tax law allows you to claim substantial deductions on both principal and interest repayments of your home loan. You also get a rebate on the stamp duty you have paid.

Data Point: You can claim up to ₹2 lakhs on interest payments and ₹1.5 lakhs on principal repayments under Sections 24(b) and 80C of the Income Tax Act, respectively.

To grasp the scale of these savings, consider a 20-year home loan of ₹75 Lakhs at 8% interest rate. Here’s how the tax savings could stack up:

Over a 20-year loan duration, the potential for tax savings is significant and depends on your tax bracket and other financial factors. However, here’s what you could approximately save, subject on your financial profile:

1. 5% Tax Bracket: ₹3,76,966

2. 20% Tax Bracket: ₹15,07,863

3. 30% Tax Bracket: ₹22,61,795

In a world where every rupee counts, taking a home loan does more than help you buy your dream house. It also sets you on a path to save a lot of money over the years. So, the next time you consider a home loan, think of it as a smart financial move, not just a debt you have to pay.

Due Diligence: Trust is Good, Verification is Better!

Why is Property and Builder/Seller Due Diligence Crucial?

Would you buy a new phone without going through a few good reviews first? Similarly, before purchasing a home, it is essential to thoroughly verify both the property and the seller or builder. Make sure there are no pending legal issues and that all necessary approvals are in place.

Before signing under the dotted line, ensure the property and its builder meet all legal and quality standards. This is a crucial step that many overlook, leading to legal headaches down the line.

Assessing the Builder’s Financial Health

The financial health of a builder not only influences the quality of the building but also ensures its timely completion.

Always do a background check on the builder by reviewing their previous projects and customer feedback. Reputed builders are less likely to leave projects incomplete.

Legal Checks and Property Verification

Key legal documents to review include land titles, municipal approvals, and environmental clearances. Take help of a legal professional to sort this for you.

The RERA Act: Your Legal Guardian

The Real Estate (Regulation and Development) Act of 2016 has made transparency between you and the builder a legal requirement. The Act ensures that builders are held accountable, mandating them to register their projects before advertising or initiating sales, thus safeguarding the interests of the homebuyers.

Did You Know?: With RERA, builders must register their projects and disclose accurate project details, simplifying your due diligence process.

Quick Tip: Choose a home loan through Finansh, and we’ll take care of checking the property and builder for you, all without any extra charges.

Conclusion: Your Home, Your Story

Buying a home is more than a one-time event; it’s a series of important choices. From picking the right lender to making your monthly EMI payments, each step is crucial. At Finansh, we go beyond offering advice; we act as your dedicated partner, simplifying this complex process for you.

We hope our “Home Loan 101” helps you navigate the tricky yet rewarding world of home loans. If you’re curious, our Home Loan FAQ section is packed with lot more details and our experts are just a call away.

Team Finansh

This 'Home Loan 101' page is authored by Finansh's seasoned team of bankers and reviewed by independent experts. Taxation insights are provided by senior chartered accountants, while legal advice is reviewed by experienced lawyers, ensuring comprehensive and reliable guidance.